Published by MBW August 10, 2021 by Tim Ingham

The record industry is headed for a gangbusters year – and we’ve got the receipts to prove it.

MBW has crunched the reported calendar Q2 financials of each of the three major music companies for our analysis below.

Want to know how good 2021 is looking for Universal Music Group, Sony Music Group, and Warner Music Group?

Our calculations have revealed:

- Combined, the recorded music arms of the three major music companies generated $4.63 billion in the three months to end of June – up by a whopping 40.1% (or +$1.32 billion) on the same period of 2020;

- When you add global publishing revenues to recorded music revenues at UMG, SMG, and WMG, things get even rosier. On this basis, the three majors generated $5.60 billion in calendar Q2 2021, up by $1.53 billion (or +37.6%) on the same period of last year;

- That $5.60 billion turnover equates to the three majors cumulatively generating $61.5 million per day in the year’s second quarter – or, in turn, $2.56 million every hour;

- Universal Music Group saw its quarterly global turnover (recorded music plus publishing) grow by a massive $607 million year-on-year in Q2; Sony Music Group’s equivalent global figure (including Japan) rose by $592 million; Warner Music Group was up $331 million;

- In the first six months of 2020, the three major music companies generated $10.91 billion – putting them firmly on course for a cumulative $20 billion year.

Focusing on the half-year results for the majors this year (i.e. the six months to end of June) shows us that Universal Music Group is now firmly in contention to get near, or maybe even surpass, a $10 billion-plus turnover in 2021.

UMG’s turnover across recorded music and publishing in the first six months of 2021, according to MBW’s calculations, stood at $4.65 billion.

That was up by $864 million year-on-year.

Universal was also comfortably the biggest recorded music company in the world at the midyear point of 2021, generating $3.97 billion from its labels and artists.

That UMG recorded music half-year number was up $807 million year-on-year versus the first six months of 2020.

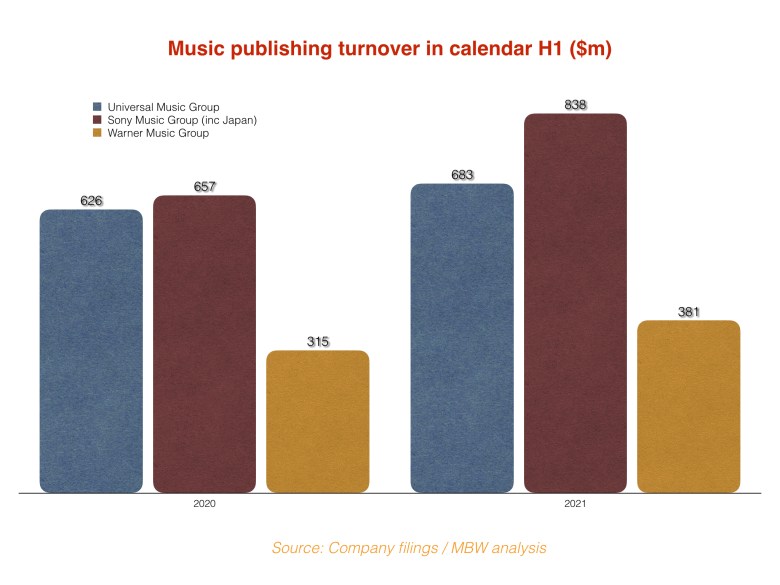

Sony, however, ran the world’s biggest music publishing company in H1 2021, by a comfortable distance.

Sony’s global music publishing operation – led by Sony Music Publishing, but also including the firm’s pubco in Japan – generated $838 million in the six months to end of June 2021.

That was up by $181 million on the equivalent revenue from the midyear point in 2020.

Combined, across recorded music and publishing, the three majors generated $10.91 billion in the first six months of 2021.

That was up by over $2.3 billion on what Universal, Sony, and Warner jointly reported in revenues for the equivalent period of 2020.

A quick note on methodology: In order to obtain USD results for the three major music companies, quarterly fiscal results for two of the three – Sony Music Group (via Sony Group Corp) and Universal Music Group (via Vivendi) – have been converted from Japanese Yen and Euros, respectively, at the prevailing quarterly currency rates, as provided by each parent company. Universal Music Group’s recorded music results in MBW’s analysis includes merchandise sales; these are reported separately to recorded music by Vivendi, but combining these two categories (merch + recorded music) brings UMG in line with Sony and Warner’s recorded music reporting. The half-year results above reflect calendar Q1 and Q2 results combined for each company, with currency converted at a quarterly rate per each three-month period.

A small caveat for the midyear numbers above: From Q2 2020 onwards, Sony Group Corp has provided a revenue number for recorded music that includes additional gross revenues paid over by streaming platforms (including a portion of those destined for its partner labels). This gross Sony figure is reflected in all calculations in this article, and is the nearest equivalent to how Universal and Warner present their figures. However, Sony’s additional gross revenue figure is not available for Q1 2020, meaning Sony’s relevant revenue number for H1 2020 in the above charts is slightly lower than the reality.

j8xxtk

otl0lq